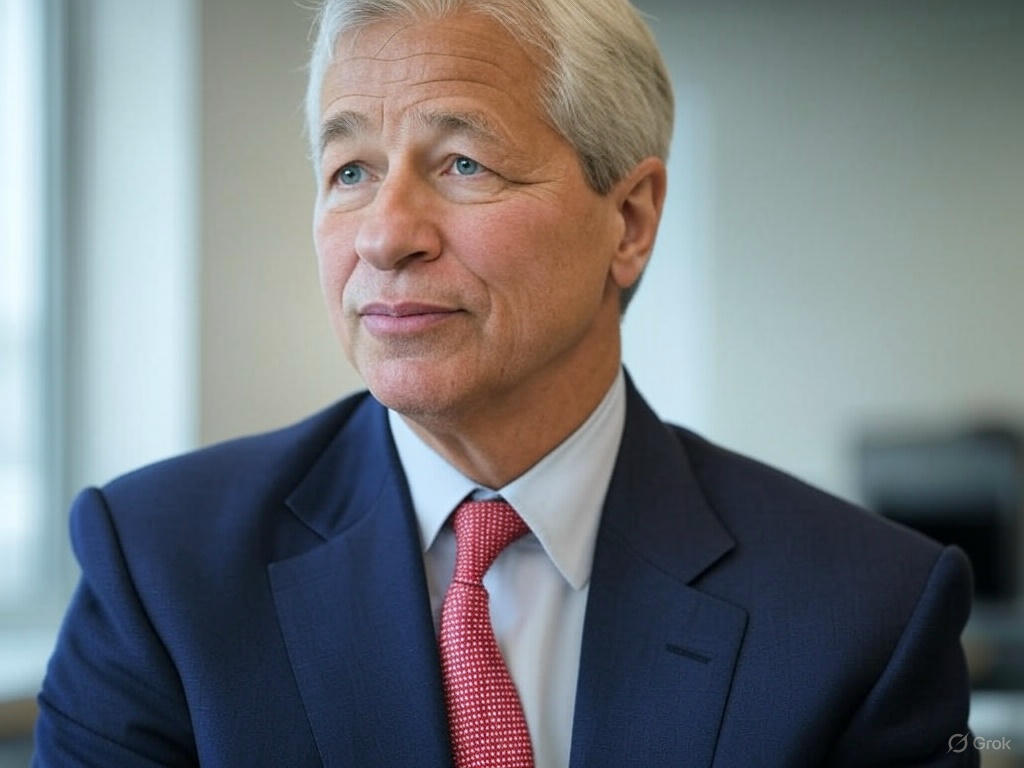

In an industry marked by volatility, scandal, and swift turnover, Jamie Dimon stands as a rare constant. Since 2006, he has been the unshakable CEO of JPMorgan Chase—outlasting his peers and emerging as perhaps the most influential banker of our time.

The Architect of Modern Banking Stability

At the heart of Dimon’s success is a concept he calls the “fortress balance sheet.” More than a catchy phrase, it’s a philosophy: banks should be prepared not just for downturns, but for black swan events. Where others built financial moats, Dimon built concrete walls—then staffed them with watchtowers.

This ultra-conservative approach to risk paid off handsomely during the 2008 financial crisis. While competitors crumbled, JPMorgan Chase remained stable—and even became the government’s go-to partner for acquiring failing institutions like Bear Stearns and Washington Mutual.

Calculated Risk, Not Reckless Moves

Though conservative in risk management, Dimon is not risk-averse. His strategy is clear: take calculated risks, understand them thoroughly, and impose accountability. Even in moments of failure—like the 2012 “London Whale” loss of over $6 billion—Dimon didn’t shy from responsibility. “Don’t put me on a pedestal,” he famously said. “CEOs make mistakes.”

The Man Behind the Empire

Dimon’s leadership has turned JPMorgan into a juggernaut. It’s now the largest bank by deposits in the U.S. and continues to grow—recently acquiring First Republic Bank during yet another industry shake-up. This expansion has reignited concerns about being “too big to fail,” a label Dimon brushes off, even as critics argue that size brings unspoken safety nets.

Still, it’s not just JPMorgan that Dimon influences—it’s the entire banking system. When a crisis erupts, U.S. Treasury officials and fellow bank CEOs alike turn to him first. In Congressional hearings, Dimon often takes the lead, fielding questions while others defer to his experience and candor.

Unfiltered, Unapologetic, Unrelenting

Dimon is as famous for his blunt opinions as he is for his financial acumen. Whether it’s calling Bitcoin a “hyped up fraud” or publicly expressing frustration with U.S. politics, what you see is what you get. He’s the same in private and public—passionate, intense, and totally focused.

The Legacy and What Comes Next

With nearly 20 years at the helm, succession questions loom. But according to those close to him, Dimon has no plans to step aside. He has no hobbies, no intention to “play golf,” and still maintains the same relentless intensity. As he puts it:

“I love my country. I love my company. I love my family. I’m going to do something—I just can’t do this forever. But I’m not done yet.”

Jamie Dimon’s story is more than a biography of a CEO. It’s a case study in leadership, discipline, and long-term vision. He’s shaped the largest bank in America—and arguably, the very fabric of modern finance—through a unique blend of caution, boldness, and unflinching authenticity.